The Social Security Administration has recently announced adjustments to the Social Security and Supplemental Security Income (SSI) benefits for 2024.

These changes reflect a 3.2% increase in monthly benefits, a notable decrease compared to the 8.7% increase seen in the previous year. This adjustment is based on the fluctuations in the Consumer Price Index for the 12-month period ending in September 2023.

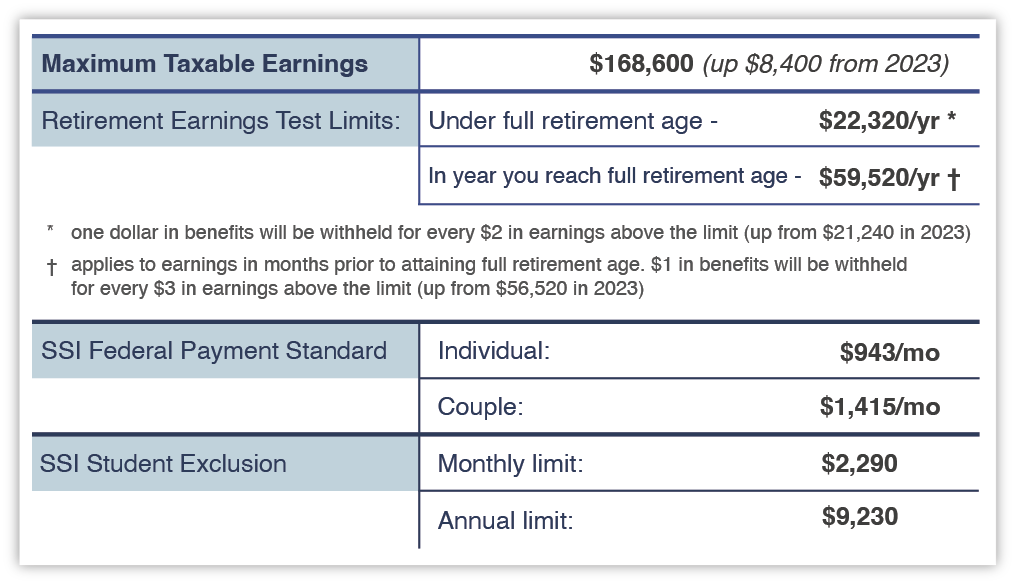

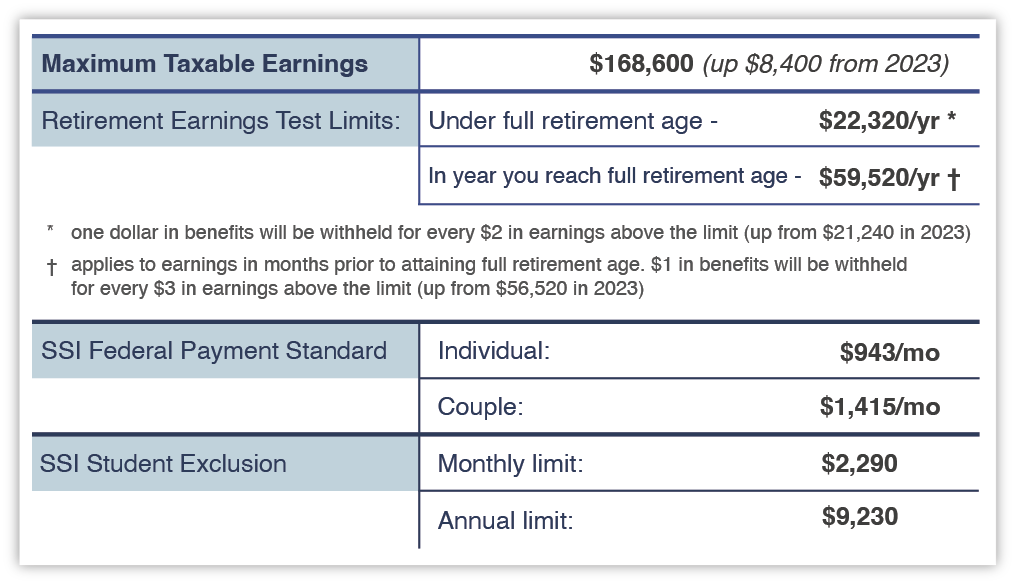

For individuals contributing to Social Security through their wages, there’s an important alteration to take note of. The maximum income subject to Social Security taxes is set to rise to $168,600, marking a 5% increase. This means that you’ll be contributing more to your Social Security taxes. Here’s a recap of the key dollar amounts:

2024 Social Security Benefits – Key Information

What it means for you:

- Maximum Income Subject to Social Security Taxes: Income subject to Social Security taxes will increase to $168,600, up by $8,400 from the previous year. Consequently, the maximum annual employee Social Security payments will amount to $10,453.20, which is an increase of $520. If you’ve paid excess Social Security taxes due to having multiple employers, you can claim a credit on your tax return.

- Average Monthly Social Security Benefit: For retired individuals receiving Social Security retirement benefits, the estimated average monthly benefit will be $1,907 in 2024, reflecting an average increase of $80 per month.

- SSI Qualifications: Supplemental Security Income (SSI) serves as a standard payment for individuals in need. To qualify for this payment, your income and resources must fall below certain thresholds ($2,000 for singles and $3,000 for married individuals).

- SSI for Full-Time Students: Full-time students who are blind or disabled can still receive SSI benefits, provided their earned income doesn’t exceed the specified monthly and annual student exclusion amounts.

Social Security & Medicare Rates

The Social Security and Medicare tax rates will remain unchanged from 2023 to 2024. These rates stand at 6.20% for Social Security and 1.45% for Medicare. Additionally, there is a 0.9% Medicare wages surtax applicable to single taxpayers with wages exceeding $200,000 ($250,000 for joint filers), which isn’t included in the aforementioned figures. It’s important to note that your employer also contributes 6.2% for Social Security and 1.45% for Medicare on your behalf. These employer contributions are factored into the self-employment tax rate of 15.3%, as self-employed individuals are responsible for both portions of the tax rate.

Jacob King

Jacob King