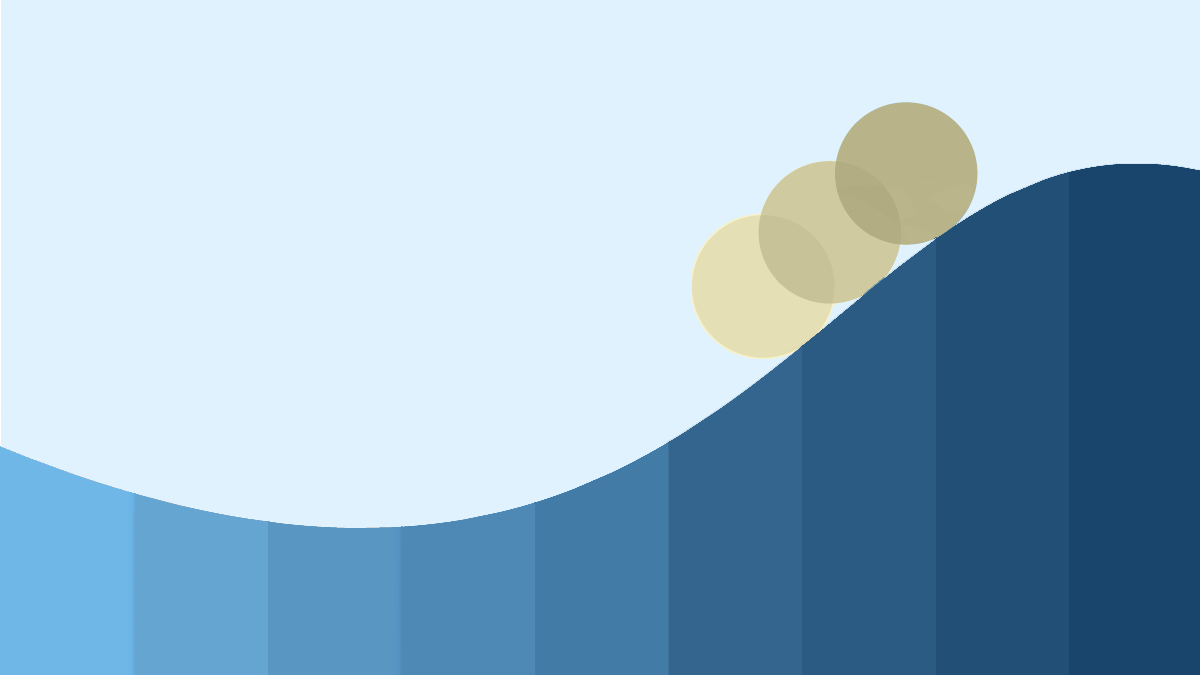

1. Keep Your Eye on the Horizon

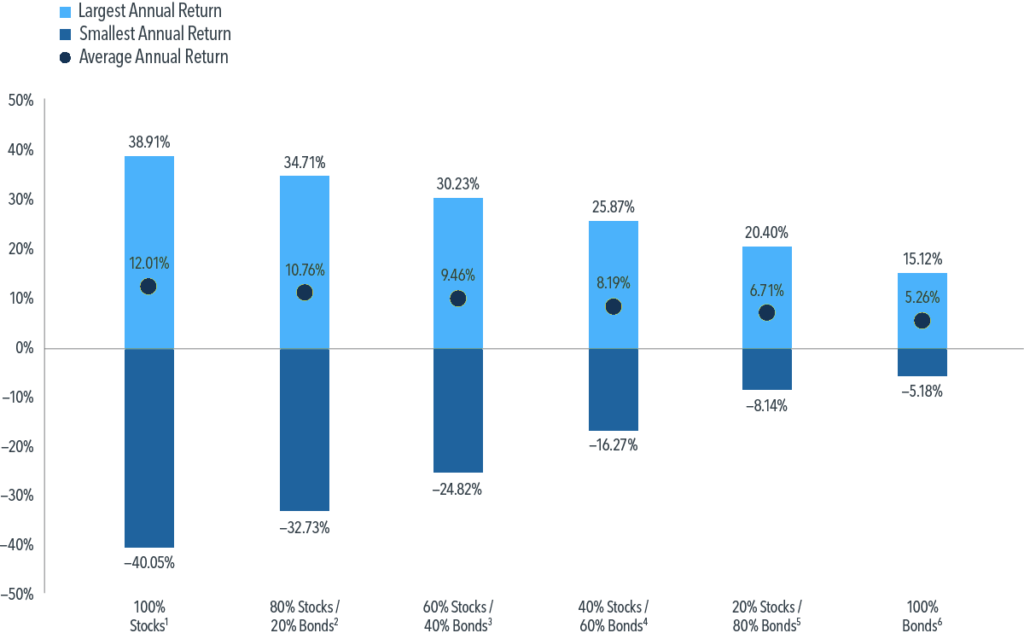

When you invest, you can expect that both ups and downs will be part of the ride. Decades of stock market returns demonstrate how often declines can happen. For evidence, look at the largest intrayear declines for the US stock market in every year from 1979 to 2023. Those declines average to -14%. However, 37 of the past 45 calendar years have ended with positive returns for the US stock market (see Exhibit 1). So instead of getting anxious over a near-term drop, keeping an eye on the horizon can help investors keep the queasiness at bay.

EXHIBIT 1

US Market Intrayear Gains and Declines vs. Calendar Year Returns (1979–2023)

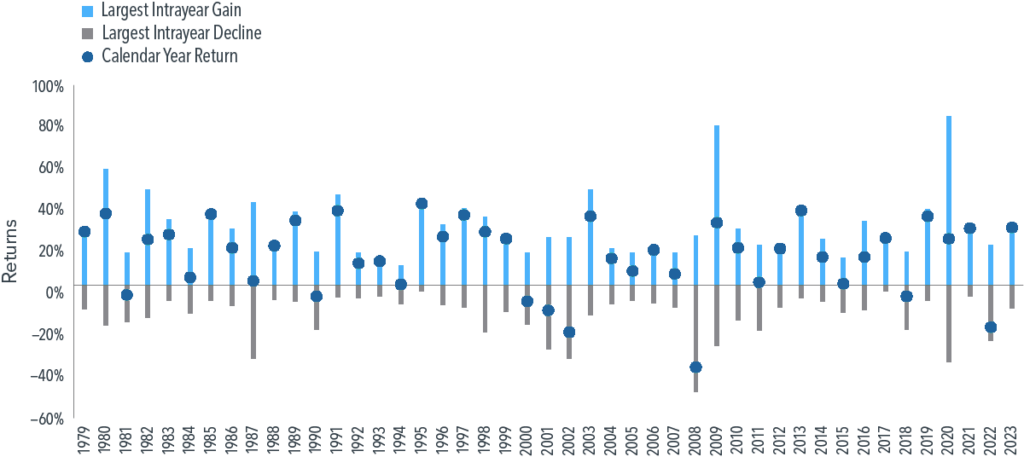

2. Stay in Your Seat

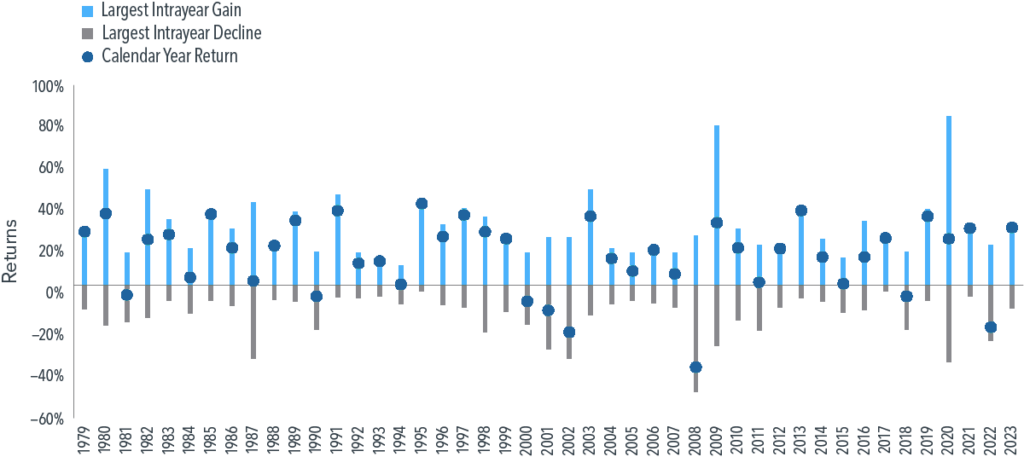

When the stock market drops precipitously, or headlines speculate it might, it can be tempting to jump out of the market to try to avoid (further) losses. But just as roller-coaster riders are warned to keep their seat belts fastened and stay seated, investors may be well advised to do the same.

Attempting to time the market to avoid the worst days could cause an investor to miss out on some of the best days (see Exhibit 2). Consider that $1,000 invested in the S&P 500 Index back in 1990 would have grown to $27,221 by the end of 2023 if left untouched. However, if an investor had pulled their money out and missed the single best day over the more than 30-year period, their ending wealth would be reduced by nearly $3,000. Worse, if an investor had missed the five best single days, their ending wealth would be reduced by more than $10,000. Over the course of decades, even a few days can make a big difference.

EXHIBIT 2

S&P 500 Index Performance Based on Time in the Market (1990–2023)

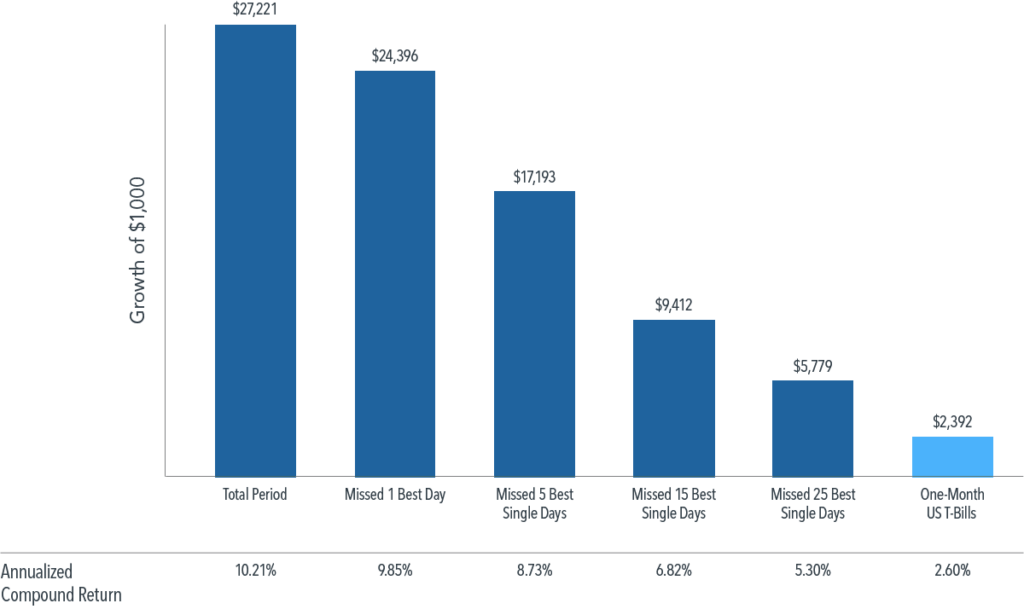

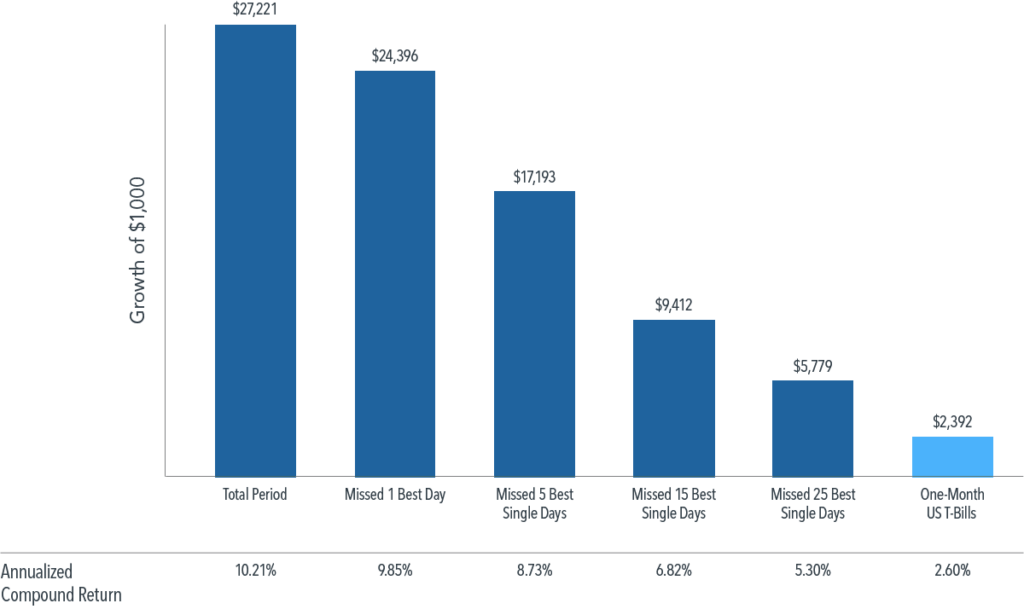

Taking a step back from the current moment may provide investors helpful perspective and put fears at ease. Markets have marched upward through the decades, even amid concerning world events, and rewarded disciplined investors over time (see Exhibit 3). This reminds investors that, despite the extreme headlines and bumps experienced in the short term, you may have a better ride by staying in your seat.

EXHIBIT 3

Growth of a Dollar—MSCI World Index (Net Dividends) (1970–2023)

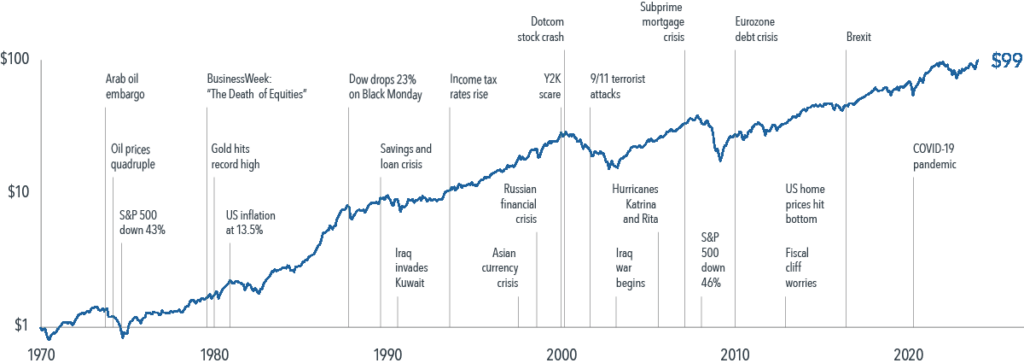

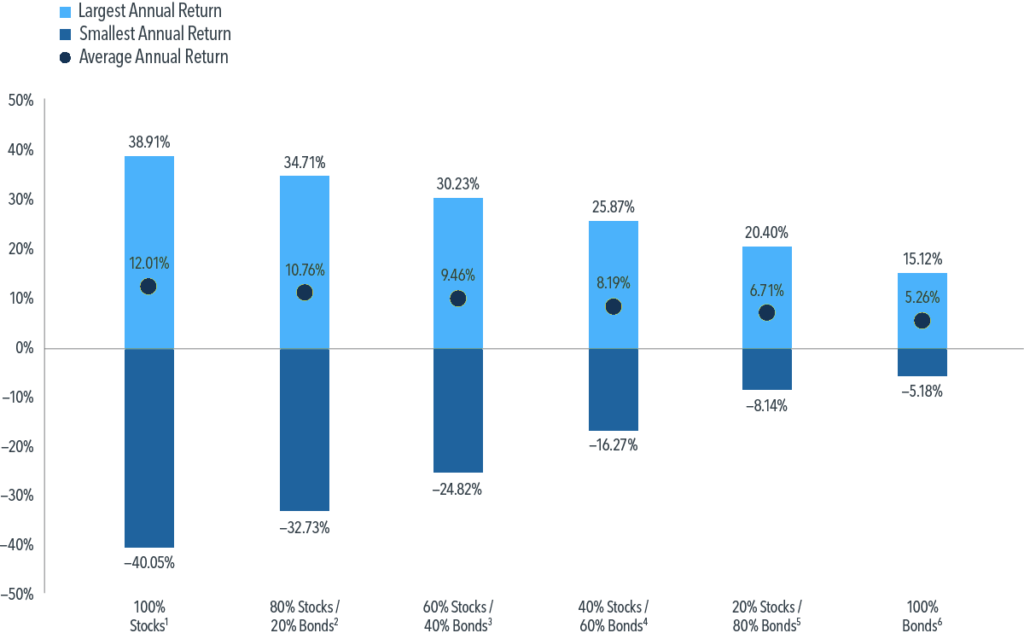

3. Know Your Thrill Tolerance

The same way theme-park goers can choose rides that align with their thrill tolerance, investors can choose an asset allocation that aligns with their risk tolerance. Financial advisors can play a key role in helping you do just that—by exploring your investment objectives and time horizons, and helping you build a diversified portfolio with the appropriate level of resilience (see Exhibit 4).

EXHIBIT 4

Stock-Bond Asset Allocation Performance (1985–2023)

Investing doesn’t have to be a harrowing, white-knuckle experience. A few simple reminders and the help of an investment professional can give you the confidence to ride out the rough patches.

Tra Sullivan

Tra Sullivan