As you consider your year-end charitable giving strategies – whether you want to support your favorite qualified charity or make your annual gift to your church – we want to remind you of three lesser-known charitable giving strategies that could serve to reduce your tax liability.

The deadline for processing charitable gifts using any of the strategies below is Friday, November 15th, so please contact us with all gifting requests prior to the 15th.

- Gifting Appreciated Securities

Compared with donating cash, or selling your appreciated securities and contributing the after-tax proceeds, donating appreciated securities is a very tax-efficient means of gifting. You avoid paying capital gains tax on the profit of those securities and you can take a tax deduction for the full fair market value of your donation (subject to limitations).

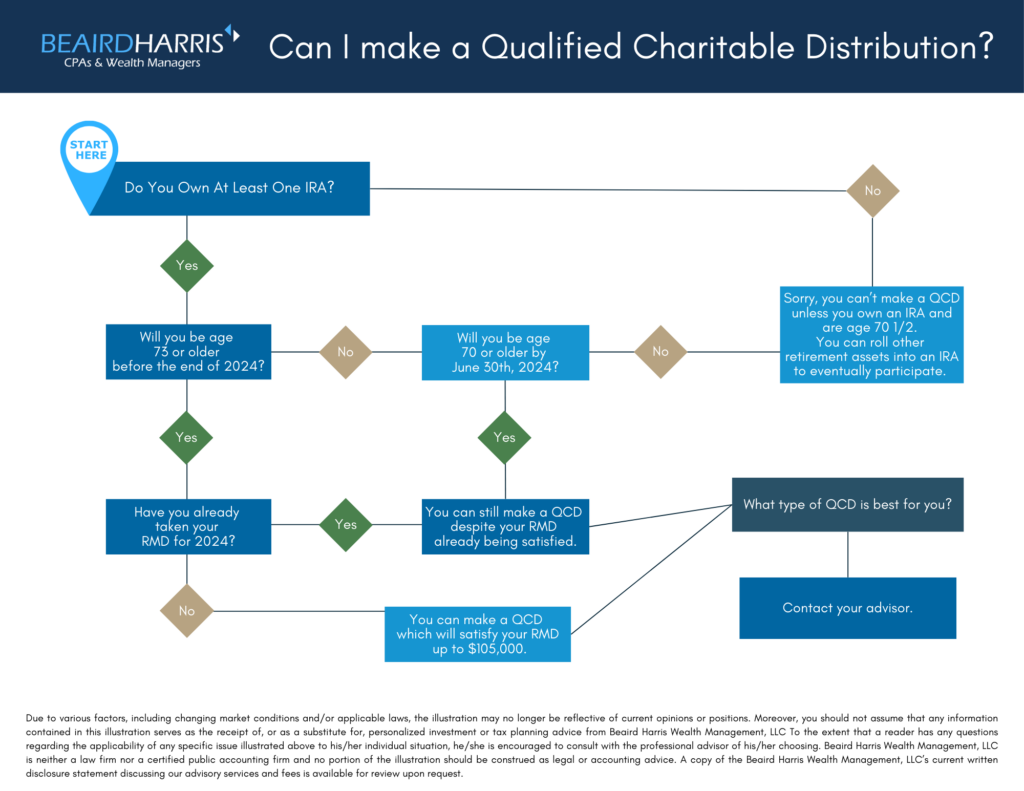

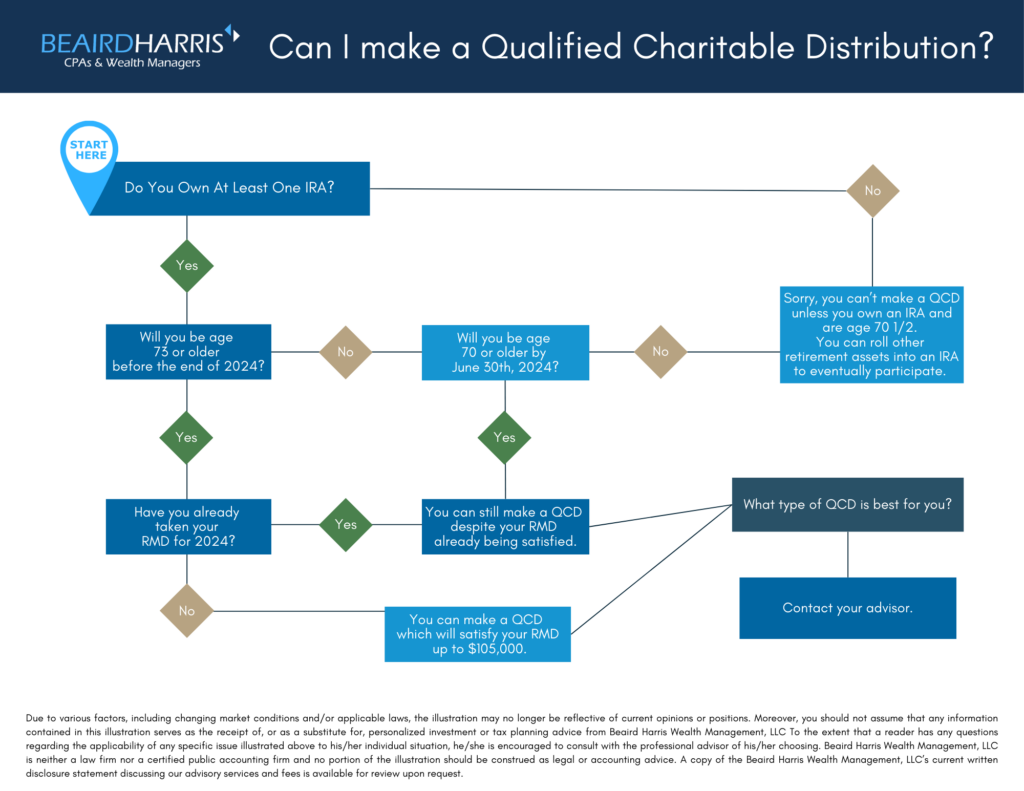

- Charitable IRA Distributions

Qualified Charitable Distributions (“QCDs”) are distributions made from an Individual Retirement Account (“IRA”) directly to a qualified charity. QCDs are permitted for individuals age 70½ and older up to $100,000 in the calendar year 2024.

When processing a QCD, the corresponding 1099 from your custodian will NOT list the distribution as a charitable contribution, thus it is incumbent upon you to notify your CPA that the distribution was a QCD. Note, QCDs cannot be made to a Donor-Advised Fund.

- Donor-Advised Fund

A Donor-Advised Fund ("DAF") is a charitable giving account that is set up with your custodian to manage your charitable donations. You receive an immediate tax deduction when making a charitable donation to the DAF and you direct the custodian when to disburse funds (grants) to the qualified charities of your choice.

This strategy works well when an individual has appreciated securities (stocks or mutual funds) that he or she has owned for at least a year and would now like to donate. Once donated to the DAF, the assets can remain there until you provide further instructions on when the funds are to be disbursed to your charity of choice. This is particularly useful when an individual has higher-than-usual income, such as from the sale of a business or a large bonus. The individual can front-load several years’ worth of charitable gifting in one year (DAF gift) to receive a larger tax deduction that particular year. Then, the individual can direct smaller amounts be made from the DAF (grants) to qualified charities over the ensuing years.

Ask Your Wealth Manager or CPA if you are looking for ways to make a difference and minimize your tax obligation before year-end.

Ginnie Baker

Ginnie Baker