As cyber threats and impersonation scams grow increasingly sophisticated, the IRS is reminding business owners that proactive...

As cyber threats and impersonation scams grow increasingly sophisticated, the IRS is reminding business owners that proactive...

A recent court ruling has temporarily paused enforcement of the Corporate Transparency Act’s BOI filing requirement, creating...

The IRS has completed a review of over one million Employee Retention Credit (ERC) claims and will now begin processing the...

A new law requiring the identity of millions of business owners to be reported to the Financial Crimes Enforcement Network...

If you're a business owner or self-employed, you may be able to deduct 50% of qualified business meals—but not entertainment—if...

The IRS keeps a close eye on small business returns that raise red flags—so it pays to be prepared. Here are five common areas...

The Texas Travel Industry Recovery Grant Program is now accepting applications to support tourism, travel, and hospitality...

As a small business owner, you may face the issue of whether to classify workers as employees or as independent contractors.

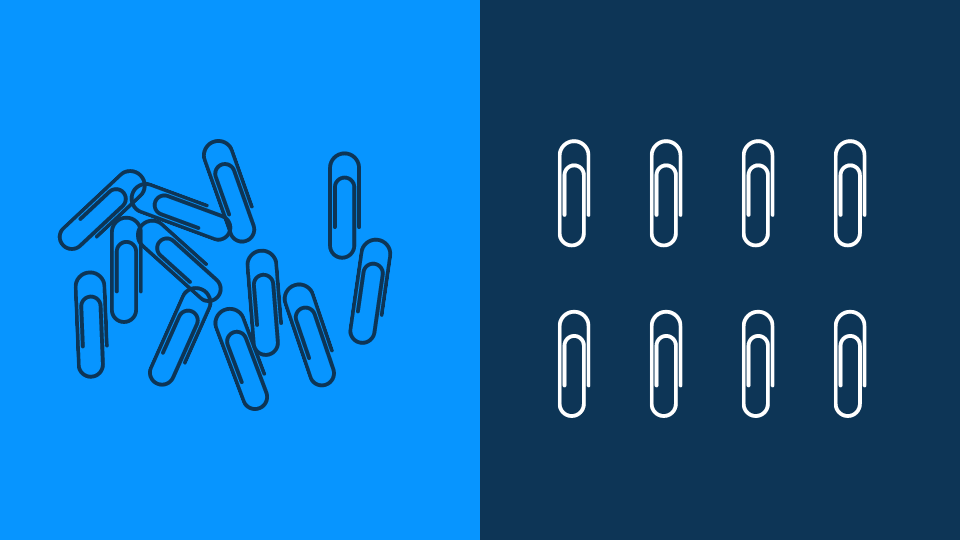

Strong documentation and organization are key to running—and eventually transitioning—a successful business. From daily...

As your business grows, operating as a sole proprietorship may no longer offer the protection or flexibility you need. Forming an...